Survey shows nearly 7 in 10 adults have a negative view of the US economy

04/21/2023 / By Cassie B.

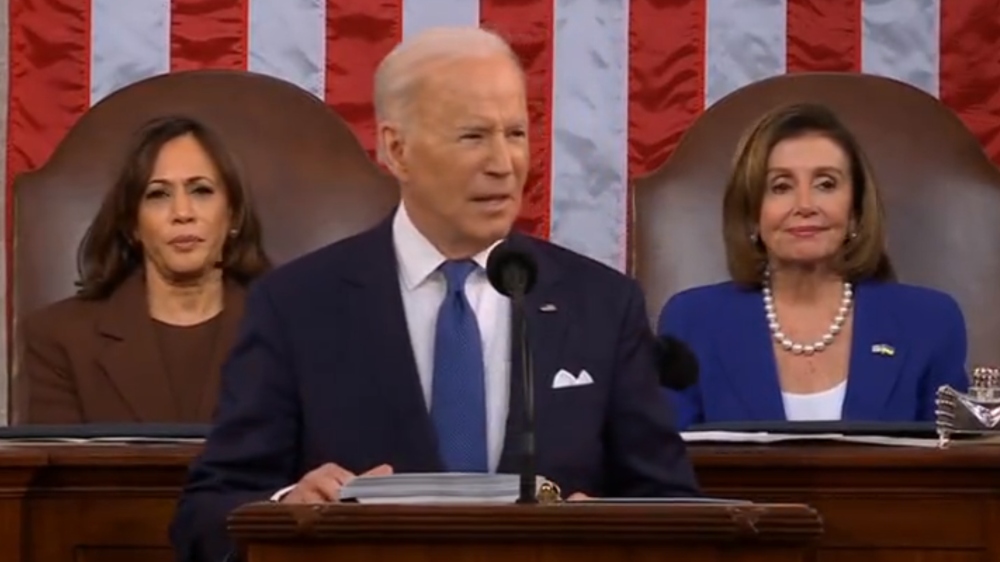

A new survey reveals that Americans’ confidence in the economy has hit an all-time low as the economic policies enacted by the Biden administration continue to take their toll.

The All-America Economic Survey from CNBC was released this week, and it showed that Americans are feeling more pessimistic when it comes to the economy right now as well as future economic conditions than at any other time in the survey’s 17-year history.

They found that Americans largely disapprove of the way Biden is handling the economy, with a margin of 62 to 34 percent. This is a notable drop from the 57 percent to 38 percent margin in November’s survey. This marks the second-worst reading on record of Biden’s presidency when it comes to the economy.

Compared to one year ago, his overall approval from Democrats fell 2 points, while it dropped 9 points from Independents.

A partner at the Democratic pollster used for the survey, Jay Campbell of Hart Research, commented: “It’s clear that as much as there is a partisan overlay to people’s attitudes, everybody is also feeling the squeeze including Democrats and that’s depressing numbers with the base.?

Meanwhile, the percentage of Americans who disapprove of Biden’s performance as president dropped two percentage points since November to 39 percent. Those who outright disapprove of his performance increased by one point to 55 percent.

When it comes to specific economic problems that are impacting Americans, inflation is the top concern. Only 5 percent of the survey’s respondents said their household income was increasing at a quicker pace than consumer prices, while just over a quarter said they are managing to keep up with inflation. Unfortunately, 67 percent say their wages are falling behind inflation.

The survey also revealed that only 24 percent of Americans believe it is currently a good time for investing in stocks. This is the lowest reading in the history of the survey; the previous record was set last quarter at 26 percent. Two thirds of respondents believe that the country is either already experiencing a recession or is headed for one.

Economic conditions are forcing some Americans to change their behavior

An incredible 81 percent of respondents reported that they have been altering their spending and changing their lifestyle in response to the economy.

For example, more than half of the working class is working more hours in order to make ends meet, although just 18 percent of the upper middle class are doing the same. Three-fourths of working-class Americans are reducing their spending on dining out and entertainment to soften the blow of inflation.

The rises in the prices of food are of particular concern right now, with 54 percent of Americans saying it has affected them the hardest. This was true across different income groups, races and political parties, although rural households appear to be affected more than urban ones and women are affected more than men.

Most Americans also said they are less likely to buy a new home or car right now because of higher interest rates. Last month, the Federal Reserve hiked interest rates for the ninth consecutive time, bringing them to a baseline range of 4.75 to 5 percent.

The survey’s findings are supported by a consumer sentiment survey from the University of Michigan, which found that the public expectation for inflation in the next 12 months rose from 3.5 percent in March to 4.6 percent in April.

The poll was carried out in early April and questioned 1,002 adults.

Sources for this article include:

Submit a correction >>

Tagged Under:

Biden, big government, bubble, collapse, currency crash, debt bomb, debt collapse, economic riot, economy, finance riot, inflation, investing, market crash, money supply, pensions, rationing, risk, savings, scarcity, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

FoodInflation.News is a fact-based public education website published by FoodInflation News Features, LLC.

All content copyright © 2022 by FoodInflation News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.